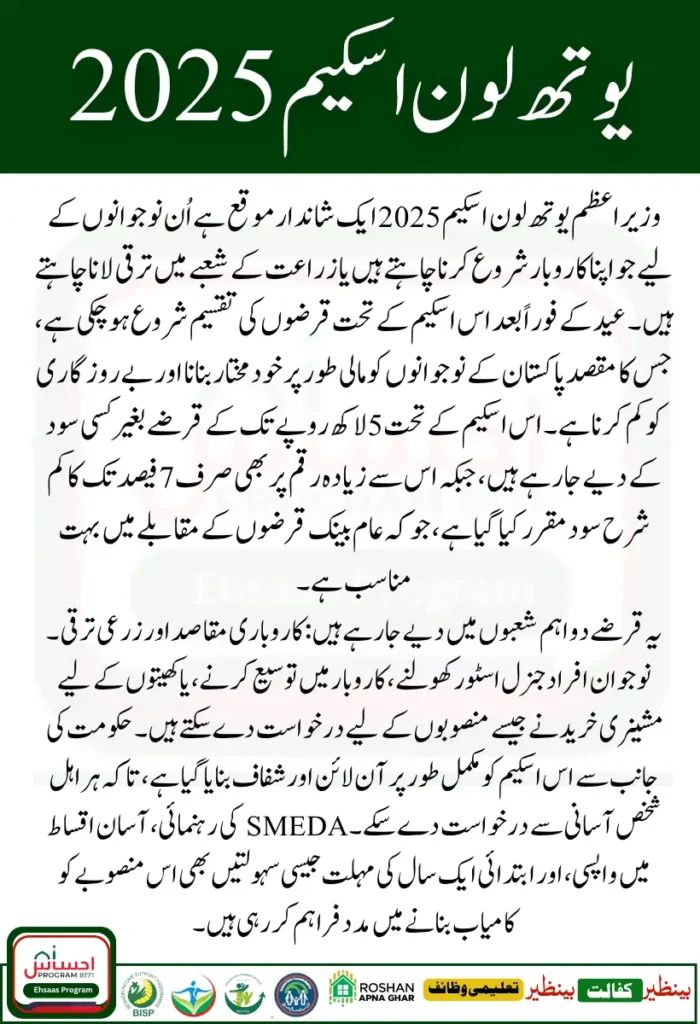

If you’re a young individual in Pakistan dreaming of starting a business or enhancing your agricultural work, there’s good news: the Prime Minister’s Youth Loan Scheme 2025 has officially started releasing loan payments right after Eid. This is the perfect time for motivated youth—whether from cities or rural areas—to access low-cost financing to turn their ideas into income. The scheme is specially launched to support individuals who lack the financial resources to start a new venture or upgrade their farming tools.

The government is actively disbursing these loans with the goal of empowering Pakistani youth to become self-sufficient and reduce unemployment. You can now apply online through a straightforward and transparent process, with funding options that range from small startups to large-scale agriculture initiatives. Notably, loans up to Rs. 500,000 come with zero interest, while higher amounts carry a very affordable markup rate of up to 7% only. This means more people from middle and lower-income backgrounds can now begin a journey toward financial stability without worrying about high-interest repayments.

Also Read It : BISP 8171 CNIC Survey Verification 2025 – Complete Guide for Beneficiaries

Whether you’re planning to launch a general store in your local market, buy machinery for your farm, or expand your current business, this scheme offers the support you need. The funds can be used to purchase stock, tools, or equipment that can enhance productivity and profits. With long-term repayment flexibility of up to 8 years and assistance from institutions like SMEDA, young people now have the right foundation to grow something sustainable and meaningful for their future.

Types of Loans Available in PM Youth Scheme 2025

The PM Youth Loan Scheme has been designed with flexibility, giving applicants a choice between two major categories based on their area of interest:

- Business Loans:

- Ideal for new startups, shop expansions, or service-based ventures.

- Loan Amount: Rs. 100,000 to Rs. 7.5 million.

- Interest-free up to Rs. 500,000.

- Agriculture Loans:

- Perfect for purchasing farming tools, fertilizers, seeds, or equipment like tractors.

- Loan Amount: Same as business loans.

- Grace period: First year requires no principal repayment—only interest if applicable.

- Supportive Policies:

- No collateral needed for loans under Rs. 1.5 million.

- SMEDA offers guidance and free business training.

- Women and differently-abled applicants are highly encouraged to apply.

| Category | Details |

|---|---|

| Loan Types Offered |

|

| Loan Amount Range | Rs. 100,000 to Rs. 7.5 million |

| Interest Rate |

|

| Repayment Period | Up to 8 years with flexible installments |

| Grace Period | First year – no principal repayment for agriculture loans |

| Eligibility Criteria |

|

| Collateral Requirement | No collateral for loans up to Rs. 1.5 million |

| Application Method |

|

| Support & Training | Guidance from SMEDA + Free business training |

| Special Encouragement | Women and differently-abled applicants are highly encouraged to apply |

| Why Apply Now? | Loan disbursement has started after Eid – ideal time to invest in seasonal business or agriculture cycle |

Eligibility Criteria – Who Can Apply?

To be considered for this loan, make sure you meet the following conditions:

- Age Requirement: 21 to 45 years (Minimum 18 years for IT and e-commerce sectors).

- Citizenship: Must be a Pakistani national with a valid CNIC.

- Employment Status: Only private individuals or unemployed persons are eligible; government employees cannot apply.

- Loan Usage: Must be used for business or agricultural development purposes only—not for personal use or consumption.

Step-by-Step Guide: How to Apply Online

Applying for the PM Youth Loan Scheme is easy and fully digital. Just follow these steps:

- Visit the Official Portal: Go to https://pmybals.pmyp.gov.pk/.

- Complete the Online Application: Fill in your CNIC, contact information, and project/business plan.

- Upload Required Documents:

- Copy of CNIC

- Business or agriculture plan

- Submit Your Application: Once submitted, your application will be reviewed within 30 to 45 days.

📝 Tip: Make sure your CNIC number, mobile number, and submitted documents are 100% correct. Errors can cause delays or rejection.

BISP 8171 Phase 3 Payment Districts List for Rs. 13,500 Distribution in June 2025

Key Benefits of the PM Youth Loan Scheme 2025

There are several reasons why this scheme stands out compared to traditional loan options:

- Zero to Low Interest Rates: Loans up to Rs. 500,000 are completely interest-free; above that, a minimal 7% markup applies.

- No Guarantor for Small Loans: You can get up to Rs. 1.5 million without needing a guarantor or collateral.

- Long-Term Repayment Facility: Borrowers have up to 8 years to repay their loans in easy installments.

- Guidance from SMEDA: Free assistance in creating and running your business through expert advice and training programs.

Why Post-Eid Is the Right Time to Apply

As Eid concludes, disbursement of approved loans has already begun. This is especially useful for people planning to start a seasonal business, invest in crops, or purchase agricultural inputs before the next farming cycle begins. Many youth have already started receiving their approved funds, and those who apply now can position themselves to take full advantage of the growing market demand post-Eid.

Pakistan’s economy is going through a tough phase, and job opportunities are limited. That’s why this initiative is more than a loan—it’s a government-backed opportunity for you to build something of your own. Whether you’re from a small town, a village, or a big city, the PM Youth Loan Scheme 2025 is designed to support your entrepreneurial dreams and help you contribute to the country’s economic revival.

Final Words

If you’re serious about changing your financial future, the PM Youth Business and Agriculture Loan Scheme 2025 is your chance to take action. It offers fair terms, quick access, and government support.

Whether you’re a young graduate with a digital business idea, a local vendor wanting to expand, or a farmer needing better tools, this program can help you succeed.

Don’t miss this opportunityapply today while disbursements are active and secure the future you’ve been planning for.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.