Why Checking Tax-Filer Status Matters for BISP Families

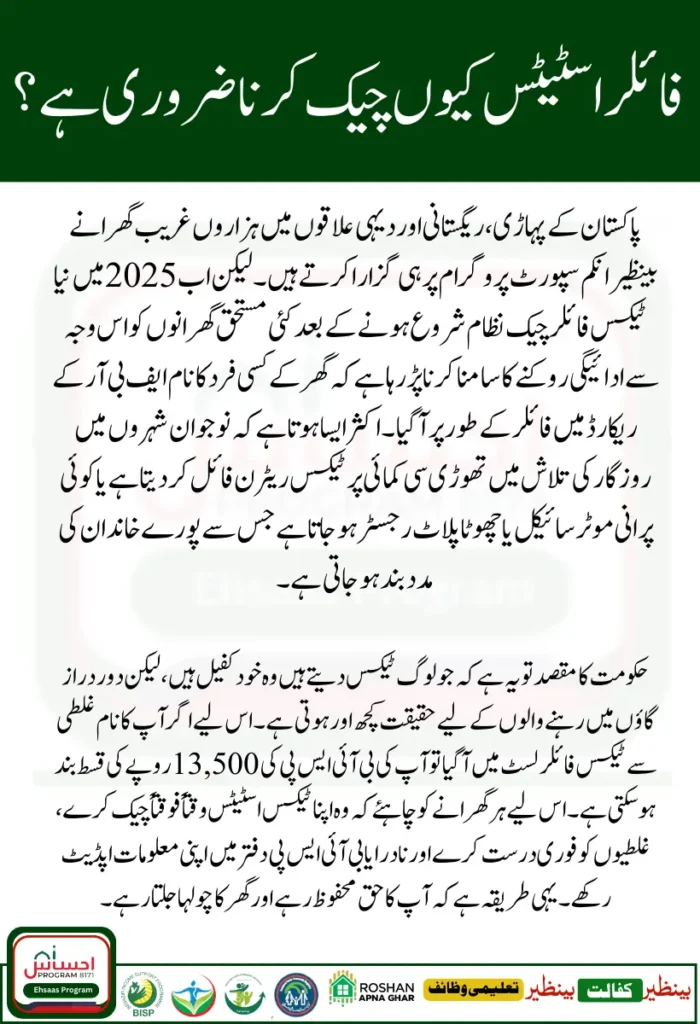

For Countless Poor BISP Families in Pakistan’s far-off deserts, mountains, and villages, the Benazir Income Support Programme (BISP) is more than just a government allowance it’s the thin line between hunger and survival. But with new tax-filer checks rolling out in 2025, many deserving families are facing payment cuts simply because someone in their household appears in the tax database.

Here’s the catch: the government’s idea behind the tax-filer rule is simple if you’re filing income tax, you must be earning enough to survive without BISP. But life in a remote area is never that simple. Sometimes, a young son takes up a job in a city, files a small return, and the whole family ends up blacklisted from support. Or an old motorcycle or a tiny piece of land shows up in the tax net and suddenly wipes out their eligibility.

For these families, regularly checking tax-filer status isn’t a fancy option it’s a must. If you don’t know where you stand, you could lose PKR 13,500 every three months money that feeds children, pays for medicines, or keeps a child in school. And once stopped, restarting BISP takes time, travel, and money things that are always short in remote areas.

So, staying alert, confirming household details, and fixing small record mistakes quickly can make all the difference. Let’s see how it works and where you should look to confirm your status.

How Tax-Filer Rules Are Impacting BISP Families in Remote Pakistan (2025)

| Topic | Details – Tax-Filer Check for BISP Families (2025) |

|---|---|

| Purpose | ✔ Confirm if anyone in your household is a tax filer to protect your BISP Rs. 13,500 payment. |

| Why It Matters | ✔ If listed as a tax filer, you may lose eligibility for BISP payments — even by mistake. |

| How to Check Online | ✔ Visit fbr.gov.pk and search the Active Taxpayer List using your CNIC. |

| Helpline Option | ✔ Call 051-111-772-772 (FBR Helpline) to ask about your tax status by CNIC. |

| In-Person Check | ✔ Visit the nearest FBR office with your CNIC and salary slip for help. |

| Trusted Help | ✔ If you live far, ask a city relative to check online or call for you. |

| Fixing Errors | ✔ Get a Non-Filer Certificate from FBR if wrongly listed. ✔ Update NADRA family data. |

| Stay Eligible | ✔ Keep your NSER survey updated. ✔ Send CNIC to 8171 for payment status. ✔ Never share CNIC with strangers. |

| Support & Help | ✔ Use BISP Mobile Vans or visit your local BISP office with all proof documents. |

| Contact | ✔ BISP Helpline: 0800-26477 for questions about PMT score or payment blocks. |

You Can Also Read : Benazir Taleemi Wazaif July 2025 Payment Delay

How the Tax-Filer System Works for BISP Checks

The Federal Board of Revenue (FBR) maintains Pakistan’s list of tax filers. The system tracks who files a return, who owns taxable assets, and who might need to pay income tax. When BISP updates its National Socio-Economic Registry (NSER) to see if a family qualifies, one of the first checks is this: Is anyone in your household listed as a tax filer?

If yes, BISP’s system automatically flags your Poverty Means Test (PMT) score as too high, which makes you ineligible. The tricky part? Many families don’t even know a family member was marked as a filer. A job in a city, a second-hand tractor, or a cheap plot of land can do the trick.

The only solution is staying in control of your records. You can’t avoid the tax-filer rule, but you can make sure it reflects your real income honestly. This is where practical steps come in — checking your status, fixing mistakes quickly, and updating your BISP profile regularly.

Also Read : BISP Kafalat Program July 2025 New Rs 14500

How to Check If You’re a Tax Filer

Living far from cities makes paperwork tough, but knowing where to check can save you wasted trips and months of confusion. Here’s a clear breakdown:

FBR Online Verification

If you or someone you trust has internet access, you can easily verify your tax status on the FBR website. Just enter your CNIC and see if your name shows up in the Active Taxpayer List. If you’re there by mistake, you need to fix it fast.

FBR Helpline Call

No internet? Use a basic mobile phone and call the FBR helpline at 051-111-772-772. Tell them your CNIC, and ask if your name or any family member’s name appears as a tax filer. Jot down what they say you’ll need it if you visit an FBR office later.

Visit an FBR Office

If your area is near a town or city, visiting an FBR office might be your best bet. Bring your CNIC, any salary slip or a letter from your local council showing your actual income. Officers can guide you on filing a complaint if you’re wrongly listed.

Ask a Trusted Relative

In deep rural areas with no phone network or net access, team up with a relative in the city. Share your CNIC details and ask them to check online or call FBR for you.

Bulletproof Steps to Clear Tax-Filer Errors

A small mistake can shut down your lifeline, so fix problems as soon as you spot them. Here’s how families in remote areas can deal with tax-filer problems step by step:

- Send CNIC to 8171: Always keep an eye on your BISP status by sending your CNIC number via SMS to 8171. It costs nothing on most networks.

- Update NADRA Info: If your household list is outdated, visit NADRA to correct family records this can prevent mix-ups that wrongly link you to a filer.

- Get Non-Filer Certificate: If the FBR says you’re wrongly listed, apply for a Non-Filer Certificate to prove you don’t pay tax.

- Take Proof to BISP Office: Bring your NADRA slip, Non-Filer Certificate, or village letter showing you earn below PKR 50,000. BISP staff can re-check your PMT score.

- Use Mobile Vans: BISP sometimes sends registration vans to remote areas. Keep an ear out for announcements so you don’t miss them.

You Can Also Read : BISP 8171 July 2025 Double Payment

Stay Eligible Keep Your BISP Status Healthy

Clearing a mistake once isn’t enough. In remote villages, paperwork can go out-of-date fast. Here’s how to avoid getting cut off again:

- Renew your NADRA family records every year.

- Keep your NSER survey updated whenever BISP teams visit.

- Always check your 8171 SMS or portal at least every quarter.

- Never share your CNIC with agents who charge money always use official channels.

You Can Also Read : BISP July 2025 Payment Status Check Online Application Tracking Portal

Final Words

Staying part of BISP might feel like wrestling with red tape especially when roads are rough, offices are far, and information is scarce. But this program is worth every effort. The PKR 13,500 payment can feed your kids, buy books, pay for a doctor, and help mothers run households with dignity. For girls, the Taleemi Wazaif bonus means more families keep daughters in school.

So check your tax status. Fix errors. Keep your household records straight. Team up with neighbors to save travel costs. And if in doubt, reach out through the official helplines. With some patience and careful record-keeping, you can keep your BISP cash coming and your family safe from hidden surprises.

FAQs

What if my BISP payment stops suddenly?

Check if someone in your household is marked as a tax filer. Use the FBR portal, helpline, or nearest office to find out. If it’s an error, fix it with a Non-Filer Certificate.

How much is the BISP payment now?

In 2025, it’s PKR 13,500 every three months some families got PKR 27,000 if they missed past payments.

Can I check my BISP status by phone?

Yes! Send your CNIC number by SMS to 8171 or visit 8171.bisp.gov.pk if you have internet.

Where can I fix NADRA or tax-filer problems if I’m far away?

Use BISP mobile vans if they visit your area, or ask a trusted person in the city to help you check online. Plan trips in groups to save travel money.

Disclaimer

⚠️ Disclaimer: This article is for informational purposes only. We are not affiliated with any government agency. For official updates, visit the official BISP website.

Note: This content is based on publicly available information. We are not affiliated with BISP or any government body. Read full disclaimer here.